Upcoming Webinars

Quarterly Newsletters

Financial Education Library

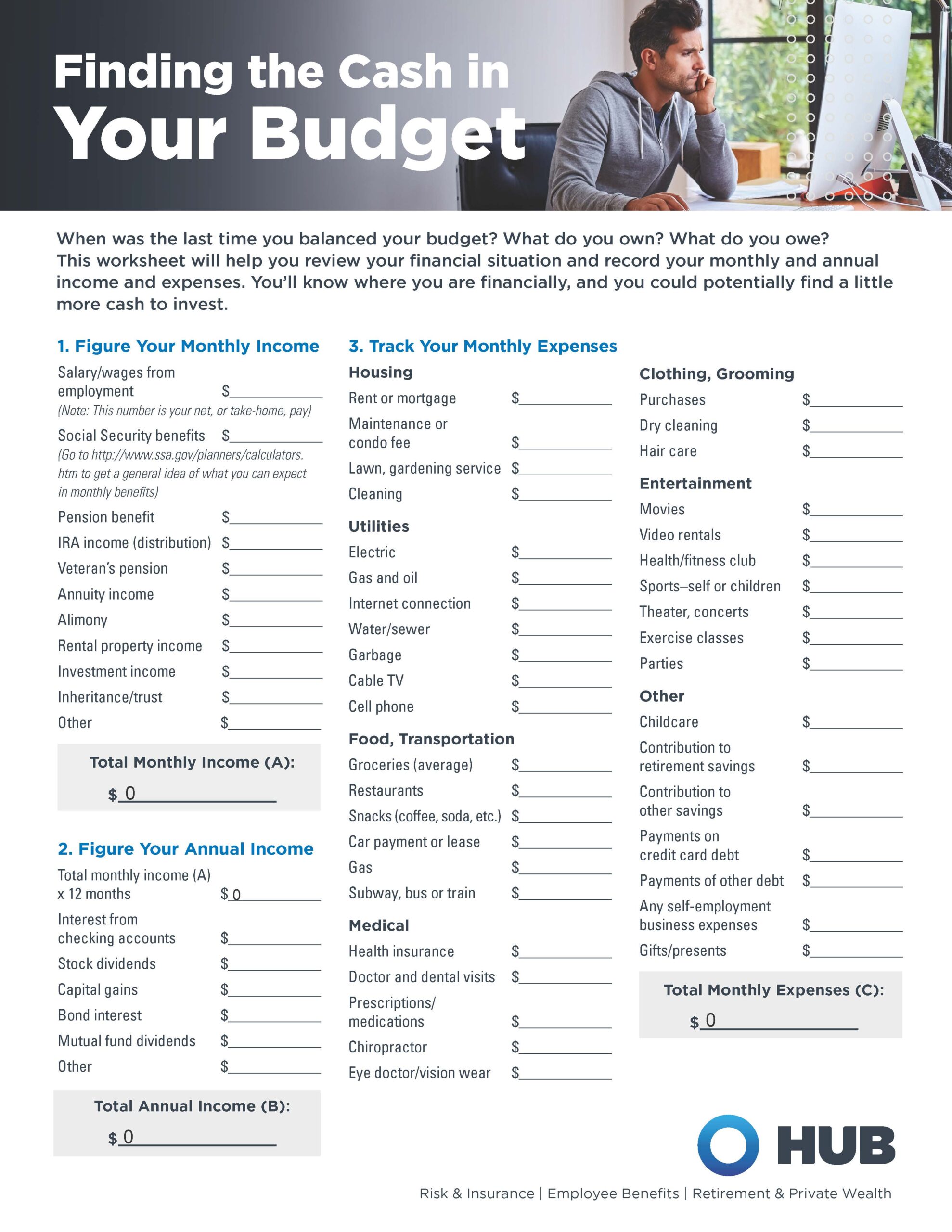

This worksheet will help you review your financial situation and record your monthly and annual income and expenses.

Guide to funding a college education for your children or grandchildren.

Estate planning is the process of anticipating and arranging how you want your assets to be divided up among your heirs when you pass away.

Tips on understanding your credit report, and fixing any errors you may find.

Tips on how to build a budget that works for your life, so you don’t have to worry about falling short of your financial goals.

If you don’t have an estate plan when you pass away, you force people to guess what you wanted. Creating an estate plan removes the guesswork.

The confidence and sense of empowerment that comes with having a formal investment strategy to meet your financial goals can be very powerful.

Steps to help take away the fear factor of retirement planning and empower you to take action to improve your financial future.

See how much you know about how you should be saving and spending by taking this quick multiple-choice quiz.

The true currency of life is time — not what you have in the bank.

If you have access to a Health Savings Account (HSA) through work, it offers an excellent opportunity to save for future healthcare costs.

Life insurance plays a key role in the financial planning process.

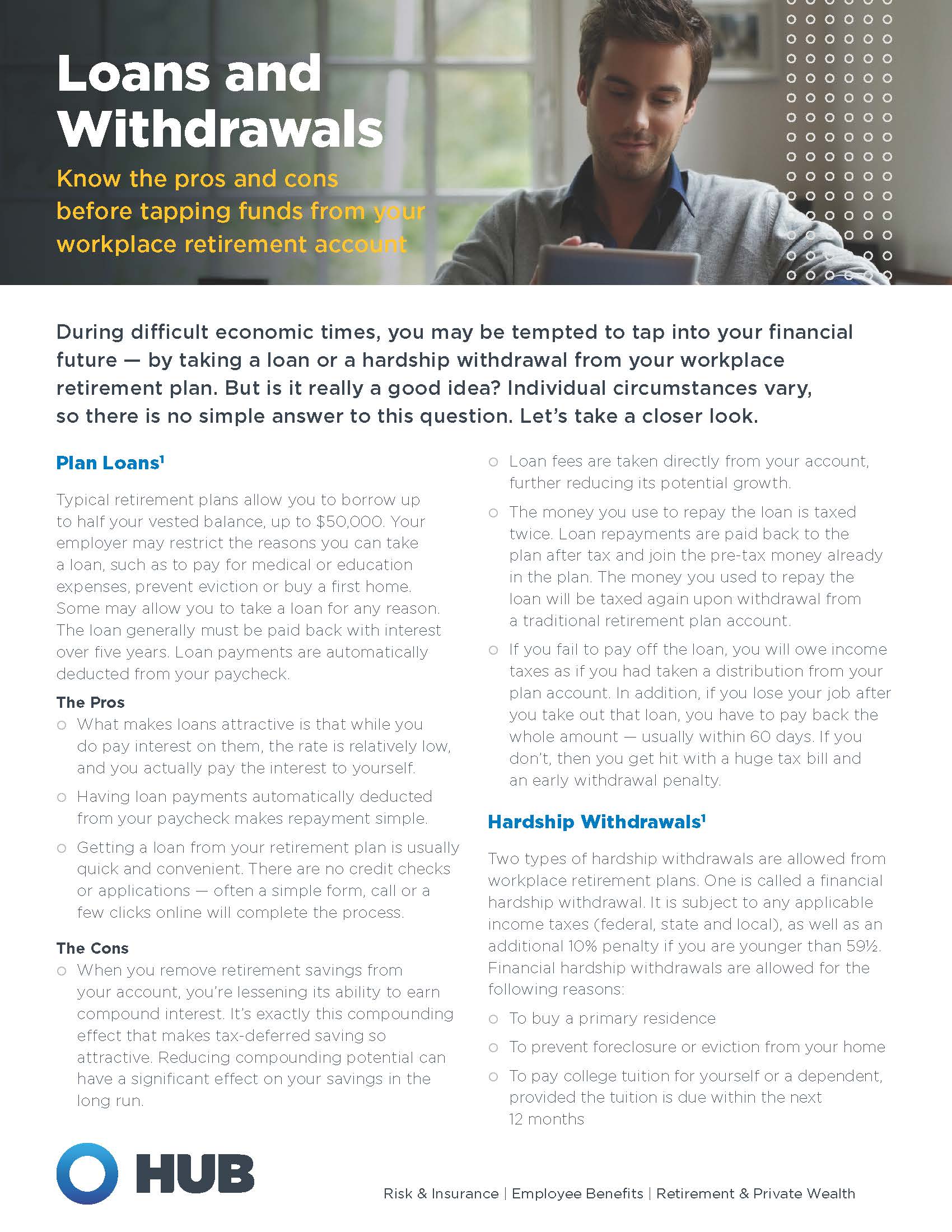

Know the pros and cons before tapping funds from your workplace retirement account.

Market swings causing you some anxiety? These four money mantras can help you overcome it.

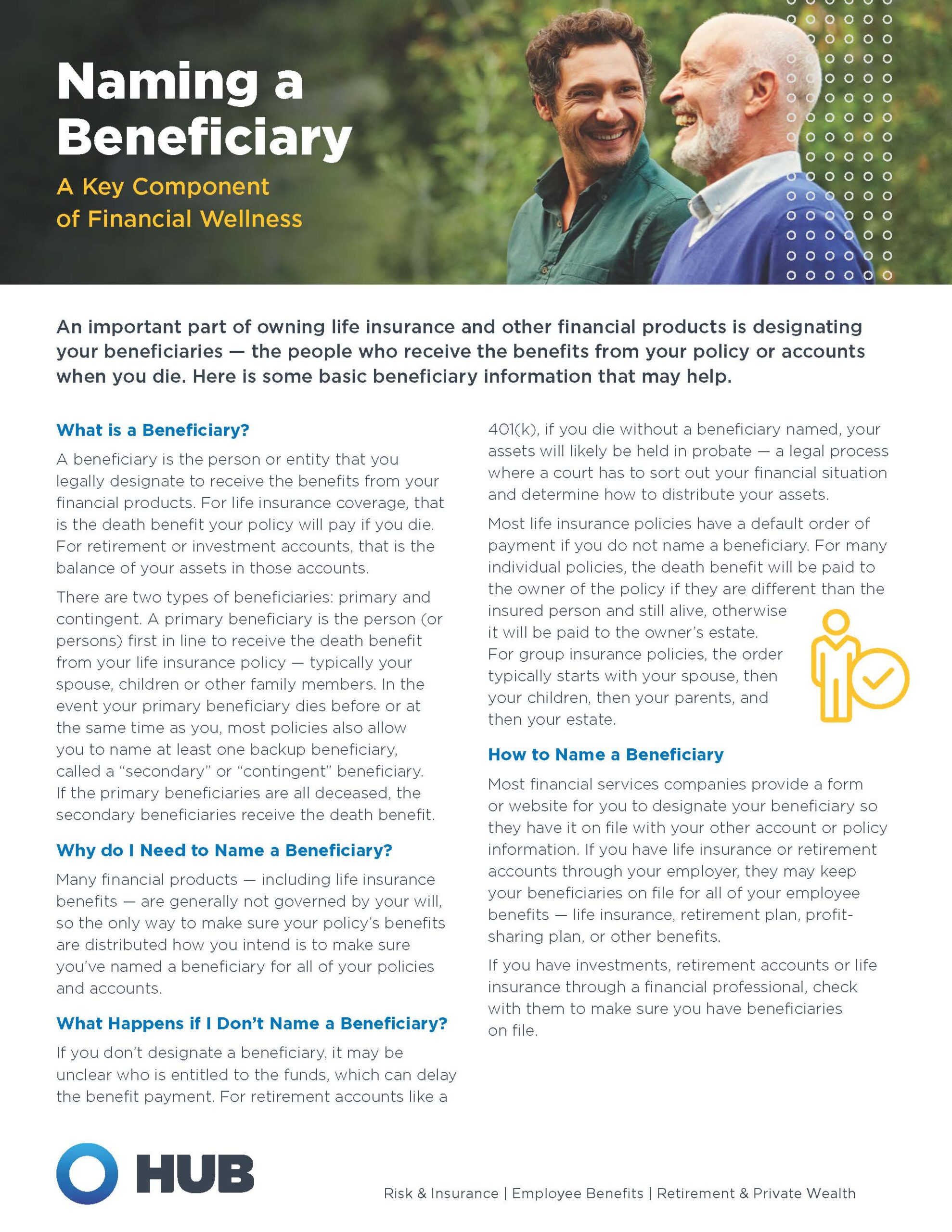

An important part of financial wellness is designating your beneficiaries — the people who receive benefits from your accounts when you die.

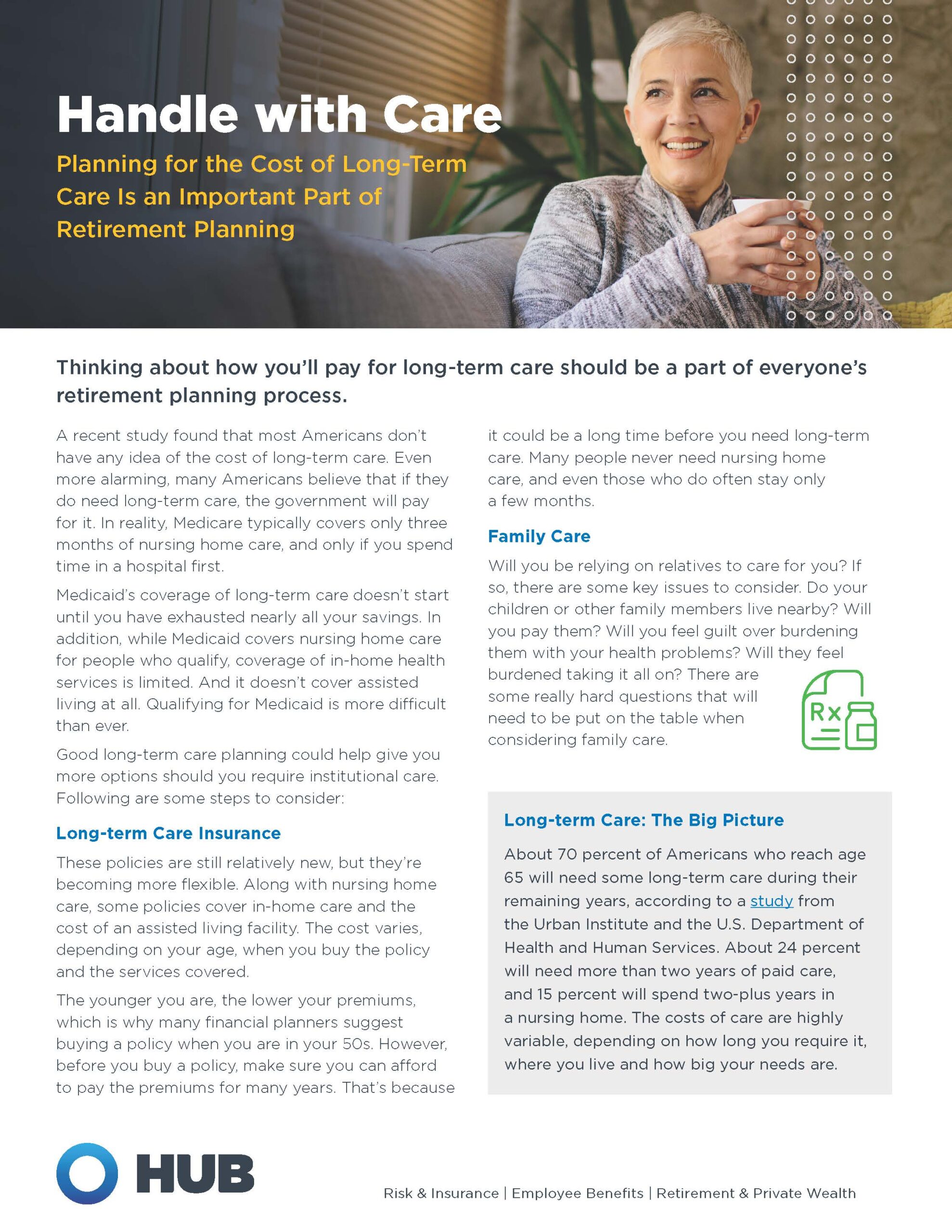

Thinking about how you’ll pay for long-term care should be a part of everyone’s retirement planning process.

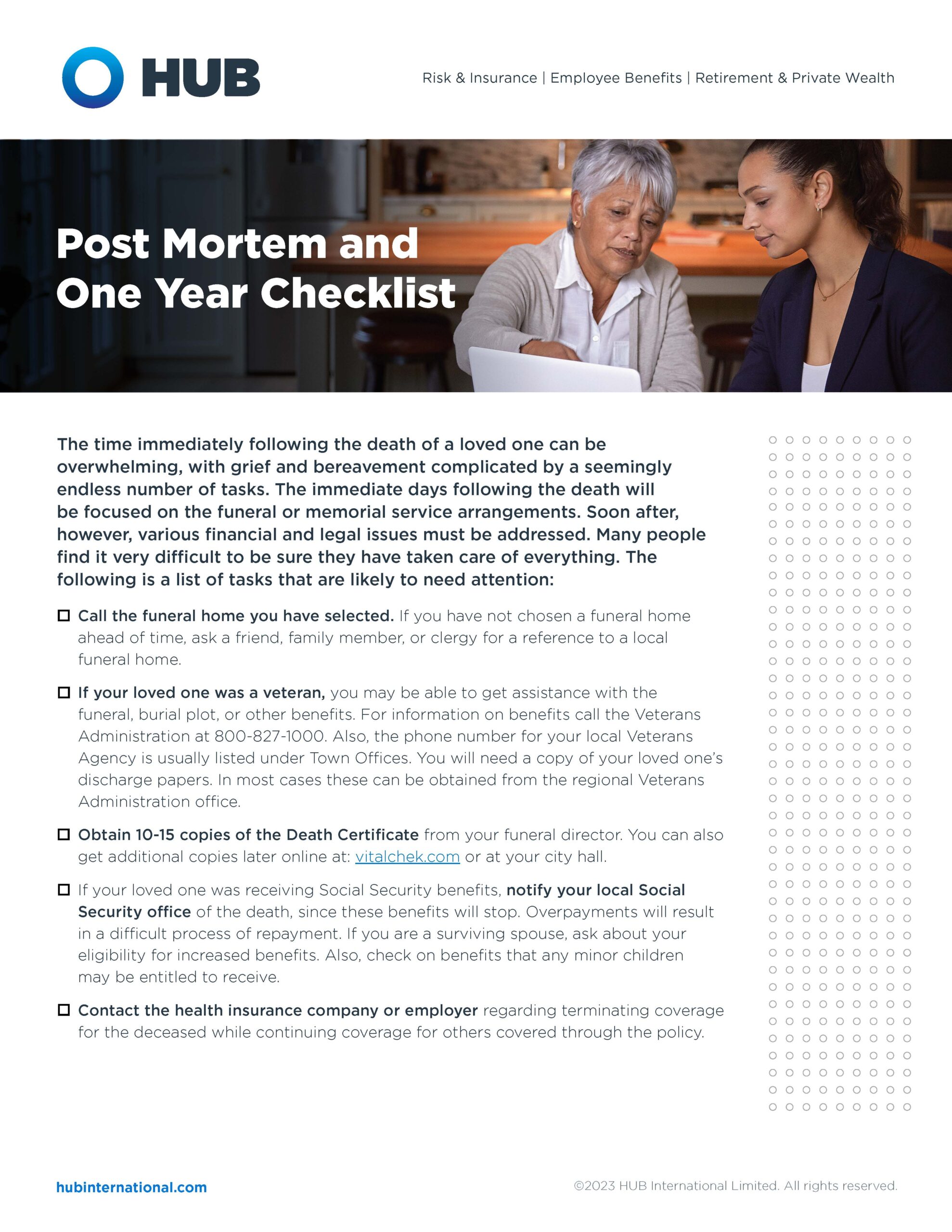

The death of a loved one can be overwhelming, with grief and bereavement complicated by a seemingly endless number of tasks.

Topics you will face as you enter retirement and steps you can take to help ensure this new period of your life is secure and enjoyable.

General questions to help you better understand inflation, it’s influence on the economy, and how it can affect your retirement planning efforts.

Each time you change jobs, it will lead to an extremely important decision: what to do with your 401(k) account through your former employer?

The following questions and answers will help you decide if Roth contributions are right for you.

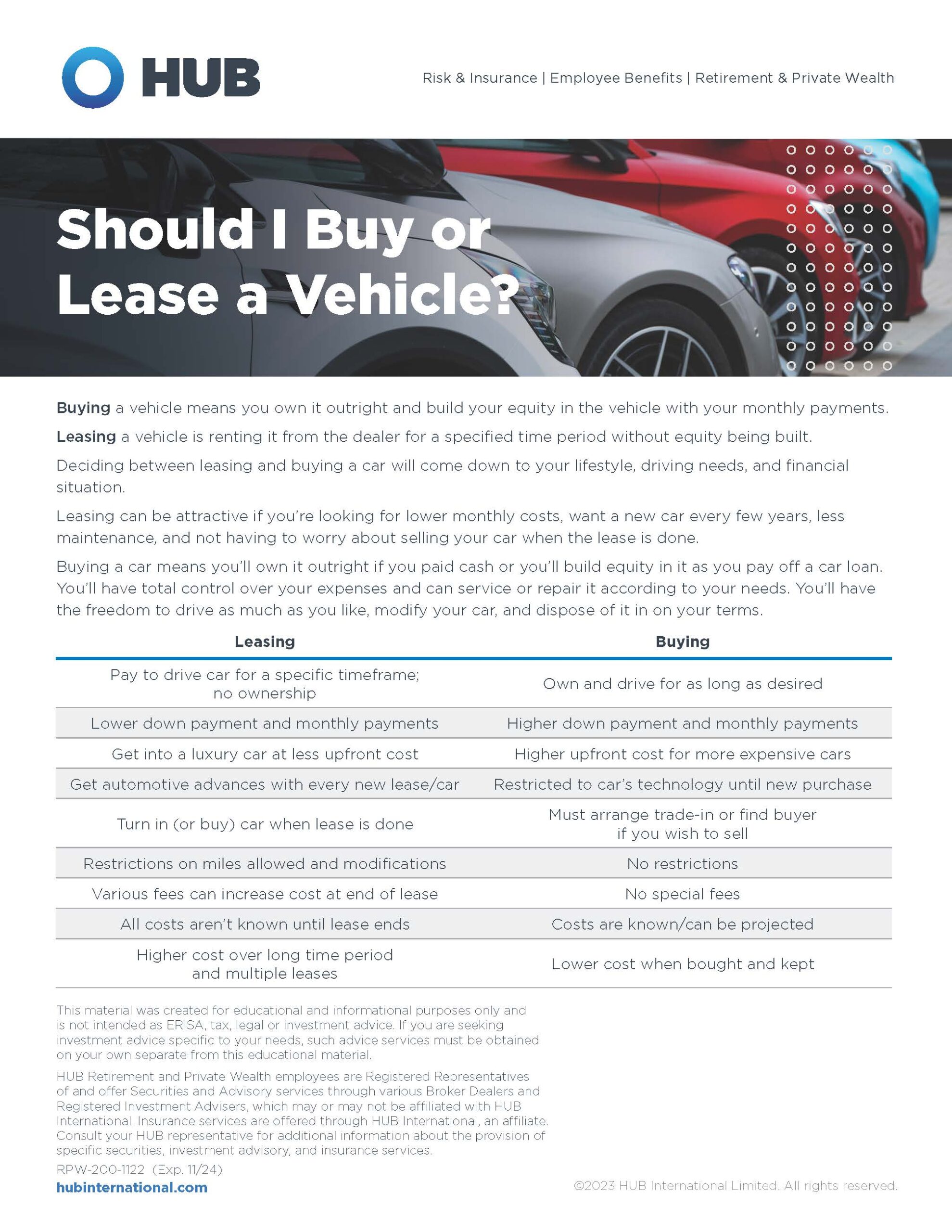

Deciding between leasing and buying a car will come down to your lifestyle, driving needs, and financial situation.

Facts about Social Security, Medicare and how they will affect your retirement.

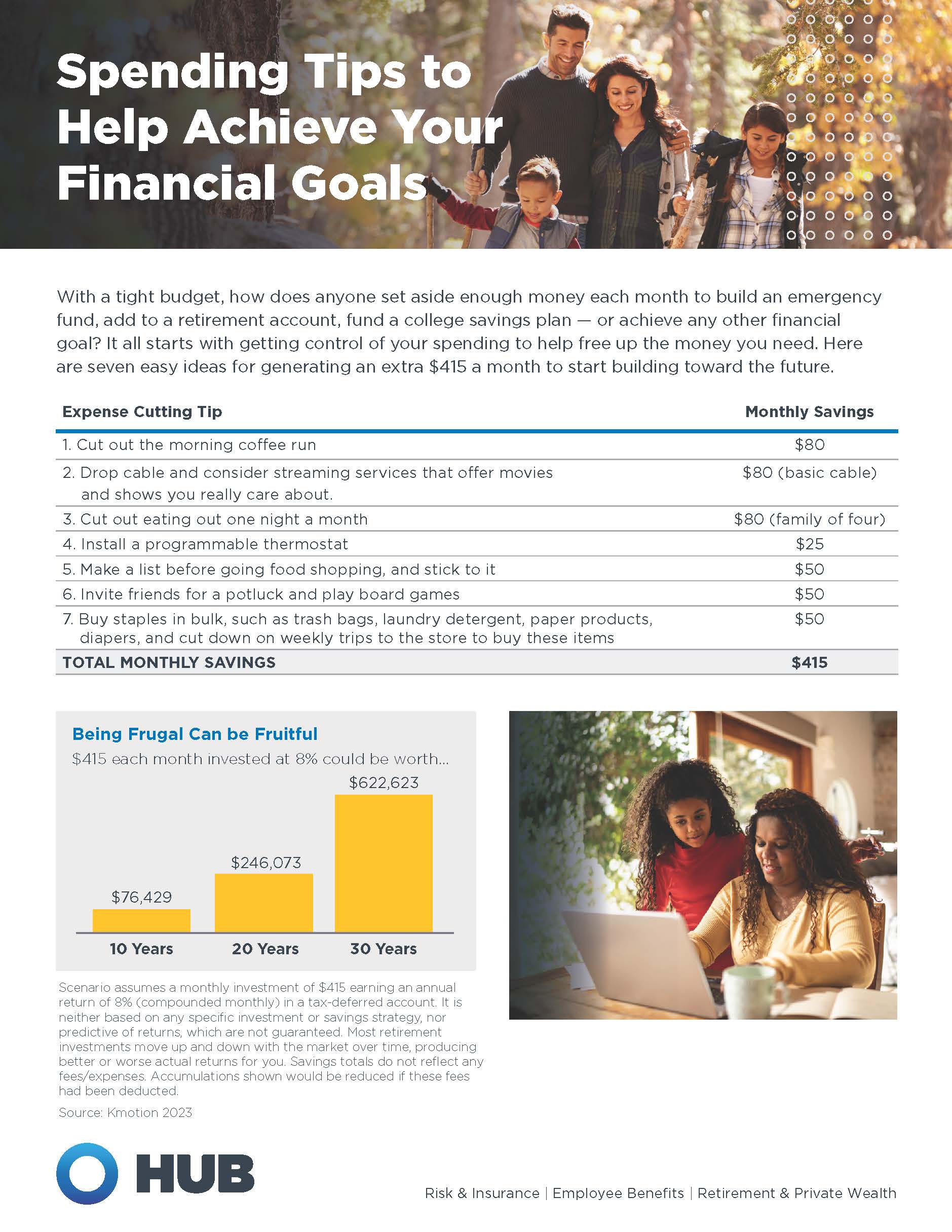

Here are seven easy ideas for generating an extra $415 a month to start building toward the future.

You could benefit from a tax credit of 10% to 50% of the first $2,000 ($4,000 if married filing jointly) you contribute to your retirement plan this year.

Before your teenagers start working or head off to college, put them on the road to financial literacy.

No matter how old you are right now, it’s always helpful to explore your expectations and concerns about retirement.

This guide helps you understand your feelings about risk, and helps you define your personal investor profile.

Documenting your digital assets is an important part of estate planning.

Knowledge to help you better understand the realities of Social Security and how it will best fit within your overall retirement income plan.

This material on this website was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.